GA Public Partnership Employment Packet Introduction to PPL 2020-2026 free printable template

Show details

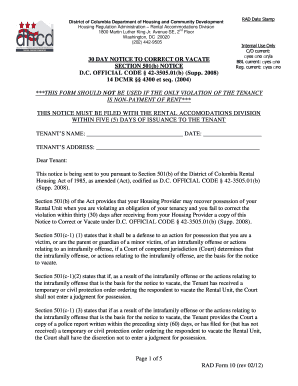

Public Partnerships LLC Georgia DBHDD NOW COMP Waiver Programs 5660 New Northside Drive Suite 450 Atlanta Georgia 30328 Toll Free Numbers Phone 1-866-836-6792 TTY System 1-800-360-5899 Administrative Fax 1-866-461-0195 Employment Packet Introduction to PPL Information for Employees Dear Employee Welcome aboard You have received this packet because a Participant who receives support through the Georgia DBHDD Waiver Programs is interested in hiring you. Financial Support Services Provider FSS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ppl employment packet form

Edit your public partnership form now form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your public partnerships job application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit public partnership employment now online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit public partnerships application packet form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

GA Public Partnership Employment Packet Introduction to PPL Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out public partnership virginia attendant packet form

How to fill out GA Public Partnership Employment Packet Introduction to PPL

01

Read through the entire GA Public Partnership Employment Packet to understand its purpose.

02

Gather all necessary personal information, such as your social security number and contact details.

03

Complete each section of the packet systematically, following any provided instructions.

04

Attach any required supporting documents that may be specified in the packet.

05

Review the completed packet for accuracy and completeness.

06

Submit the packet to the appropriate agency or office as instructed.

Who needs GA Public Partnership Employment Packet Introduction to PPL?

01

Individuals seeking employment through the GA Public Partnership program.

02

Support workers who will be providing services under the program.

03

Families and caregivers looking to employ personal support workers.

Fill

public partnership ppl form comp

: Try Risk Free

People Also Ask about public partnership ppl comp get

Does public partnerships pay holiday pay?

Ten paid holidays per calendar year.

What is the phone number for public partnership Oregon?

Our phone and text lines are open from 8am - 5pm PST. Please give us a call at 844-378-2931, or text us at 503-208-4923 during these hours and a member of our Customer Service team will assist you.

What is the phone number for public partnerships LLC PA?

PPL has a Customer Service Center. This is for members, employees and Support Brokers. The Customer Service Center can be reached by calling toll-free at 1-888-419-7753.

What is the phone number for IP One?

Schedule a one-on-one virtual and over the phone training by calling IPOne Customer Service at 844-240-1526 for assistance.

How to apply for public partnership in Virginia?

Submit an Attendant Application Call the Enrollment Hotline at 1-877-908-1752, Monday through Friday, 8:00AM to 8:00PM and Saturday 9:00AM to 1:00PM. NOTE: Only the EOR may call the hotline.

How long does it take to get paid from public partnerships?

The whole process will take 1 to 2 pay cycles from the time we receive your completed and signed application. If there is a change in bank account information, your PPL payment account will be taken off Direct Deposit status until the new bank account information is verified. Verification may take a few weeks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit public partnership employment packet virginia from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your public partnership employee packet into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send public partnership attendant packet to be eSigned by others?

Once your ppl customer service is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in publicpartnerships com without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing employment ppl form print and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is GA Public Partnership Employment Packet Introduction to PPL?

The GA Public Partnership Employment Packet Introduction to PPL provides guidelines and necessary documentation for individuals participating in the Public Partnership program in Georgia, designed to facilitate employment opportunities in personal care services.

Who is required to file GA Public Partnership Employment Packet Introduction to PPL?

Individuals who wish to participate in the GA Public Partnership program, including those seeking to hire personal support workers or looking to manage their own services, are required to file this employment packet.

How to fill out GA Public Partnership Employment Packet Introduction to PPL?

To fill out the GA Public Partnership Employment Packet, individuals need to provide personal information, select the appropriate employment options, complete necessary consent forms, and submit the packet to the designated authority as outlined in the instructions.

What is the purpose of GA Public Partnership Employment Packet Introduction to PPL?

The purpose of the GA Public Partnership Employment Packet is to streamline the process for enrollees to manage employment within the Public Partnership program, ensuring compliance with state regulations and facilitating the hiring of personal support workers.

What information must be reported on GA Public Partnership Employment Packet Introduction to PPL?

The packet requires reporting personal identification information, details about the services to be provided, information about the employed personal support workers, and any necessary consent for background checks or other compliance measures.

Fill out your GA Public Partnership Employment Packet Introduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employment Ppl Form is not the form you're looking for?Search for another form here.

Keywords relevant to ppl georgia

Related to public partnership application online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.